The Employer “Family Glitch” has been removed!

All additional family members can now qualify for a government subsidy.

Now Get a Government Subsidy!

If you were denied a subsidy because your spouse had employer coverage, this rule change is for you!

Affordable Health Insurance Within Reach for More Families

About half of the U.S. population gets their health insurance through their employer. This provides a wonderful benefit to the employee, because a minimum of ½ (50%) of the total cost of that health plan for that employee must be covered by the employer, if the employer offers group health insurance to their employees. In many cases, employers pay more than 50% of their employees’ premium, and the rest is paid by the employee.

Call For FREE Help (702) 898-0554

When you combine what the employer pays, and what the employee contributes out of their paychecks, this makes the overall dollars spent on a health plan higher. This generally will give the employee a much better health insurance policy than they normally would if the employee had purchased it on their own.

Across the country, employers cover an average of 83% of the employees’ health insurance costs. Many employers, however, do NOT contribute anything towards the spouse and kids’ portion of the health insurance premium. Employers are not required to help pay for spouse and children. But because of rules, employers are required to OFFER to spouse and kids, but they are not required to PAY for spouse and kids. This makes the amount of premium the employee would have to pay to cover their spouse and kids extremely expensive! Because the spouse and kids are full price.

What Is the Family Glitch?

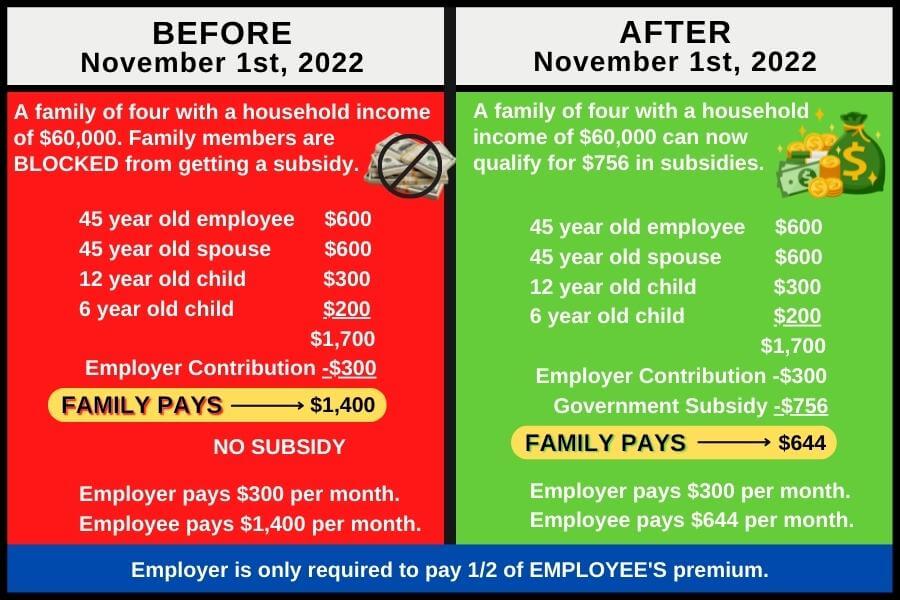

So, here’s the rub. Up until now, for the past few years since the Affordable Care Act was passed in 2010, if an employee was “offered” health insurance through their employer-based plan, in almost all cases, the spouse and children would be BLOCKED from qualifying for a government “subsidy” (government helps pay). It didn’t matter if the employee enrolled into the employer’s health insurance or not, they would still be blocked from a subsidy. The options for this family were: they could pay full price for their employer group plan for the spouse and kids, enroll in a private plan for spouse and kids, or enroll into a Marketplace plan for the spouse and kids (but they would be paying full price). Only a very small percentage of these Nevadan’s spouses and kids’ could qualify for a subsidy, because the employee’s plan was considered “unaffordable”. The reason they could not get a subsidy is because the employer’s health plan was considered “affordable” to the employee, and the employers affordable health plan to that employee would BLOCK their spouse and kids from qualifying for a government “subsidy”.

This was the “Family Glitch”

NOTE: This is an example only. Individual circumstances play a factor in pricing and subsidy amounts.

Call our office for an individual quote for your family.

Now this same family pays $300 for the employee coverage and $200ish (or almost $0) for the spouse and kids.

Based on a household income of $60,000, the spouse and children now qualify for $756 in subsidy. They can now shop for a Silver plan that may cost more like $200ish or a Bronze plan may even cost $0.

Note: This depends on the plan chosen and many other factors.

Call us for assistance and to find out what you are eligible for.

Call Us For Assistance

(702) 898-0554

Get a Fast & Free Online Quote

Time To Celebrate!

In October of 2022 the Treasury Department announced new rules to the American Rescue Plan Act, stating that starting on 1/1/2023 employees that are offered “affordable” health insurance by their employer, their family members may now qualify for a subsidy! “Affordability” is calculated in a way that the health insurance plan costs the family less than 9.12% of their household income. This household income will determine what amount of subsidy the family would qualify for, then the family can decide what health plan they’d like to enroll into. This is such a huge deal! We’ve seen so many families that desperately needed the tax subsidies, but because of this family glitch, the family members of the employee were not eligible. Many of these Nevadan’s had pre-existing conditions that really needed coverage, and this put the employee in a situation that made them think twice about their employment.

Advanced Premium Tax Credit

This subsidy is called an “Advanced Premium Tax Credit”, meaning, in advance of your premium being due on the 1st of every month, your health plan premium will be reduced in the form of a “subsidy,” which is based on factors such as your family size and income. You’ll only pay a percentage of your income for your health insurance plan. The higher the income the lower the subsidy, the lower the income the higher the subsidy. Be careful to report and state the correct and accurate income the very best you can, because you’ll have to account for your stated household income (and the overall amount of subsidy dollars you took) to the IRS, in the following year.

Who Benefits from the New Rules and gets to Celebrate?

In the past few years, if employed Nevadans that had group health insurance were super lucky, (probably less than 5% of the population) where the employee’s portion of the health insurance was considered “unaffordable”, (this means that the employee’s portion of their health insurance premium must be considered unaffordable), then the spouse and kids could get a subsidy to help pay for their health insurance, but this occurrence was very rare. Under the new rules, the affordability of employer-subsidized health insurance is based on the cost of insuring the entire family, not just the employee. There are estimates that the new rules will put affordable health insurance within reach of about a million people nationwide. The new rules go into effect for families who apply for 2023 coverage during this years open enrollment period – November 1st, 2022, through January 15th 2023.

How We Help You For FREE – Nevada Insurance Enrollment

Finding health insurance coverage that fits your needs and budget can be challenging, and ever-changing rules can make it confusing to determine what you qualify for. Our agents study the different insurance companies’ health insurance plans and options each year. They know what HMO, EPO, and PPO options are available from each insurance company. They know how the plans work, how the coverage works, what coverage you’ll have outside of Nevada, can answer difficult questions, and help with situations that may need additional research.

At Nevada Insurance Enrollment, our health insurance agents are knowledgeable, patient, caring, and can help you determine whether you may benefit from the new rules regarding the family glitch, and if you can save money by purchasing health insurance through Nevada Health Link. Our services are free to our clients. We are paid by the insurance companies to assist Nevadans into health plans that work best for them, and your insurance premiums will not go up in price one cent for using our assistance. Your plan will cost you the same with or without assistance. It only makes sense to get the help you deserve from a licensed agent. Call us today at (702) 898-0554 for an appointment in person or over the phone.

Related Articles:

♦ 2023 Obamacare Health Insurance Open Enrollment in Nevada

♦ Is My Health Insurance Affected If I Miss Open Enrollment?

♦ What is Health Insurance Open Enrollment?

♦ Health Insurance WITH a Subsidy

Read More: Health Insurance in Las Vegas, Nevada

Call us for assistance

(702) 898-0554

Serving Las Vegas, Henderson, North Las Vegas and the entire state of Nevada

Three Ways to Enroll

1). Apply by Phone

(702) 898-0554

2). Apply in Person

(by appointment ONLY)

Please call to make an appointment

3). Online Quote

Why Go Anywhere Else?

When you can have an experienced and caring professional guide you.

Insurance Quotes | Plans | Coverage

Nevada Insurance Quotes

Serving Las Vegas, Henderson, North Las Vegas and the entire State of Nevada

Auto | Homeowners | Health | Life | Medicare | Funeral / Cremation | Group Health | Short Term | Dental & Vision | Travel Insurance

Authorized Agent for: Nevada Health Link, Anthem Blue Cross & Blue Shield, Sierra Health & Life, Health Plan of Nevada, Aetna, Prominence, Hometown Health, Ambetter/Silver Summit

Farmers Insurance – Shelly Rogers Agency in Las Vegas, Nevada