NO Subsidy

Health Insurance

Purchase Health Insurance

With NO Subsidy

OFF Exchange

You have been directed to this page because…

You Make Too Much Money

Or

You Do Not Want a Subsidy

Why No Subsidy?

If you do not want a subsidy, or make too much money to qualify for a subsidy, you can shop for health insurance OFF Exchange (in the private market). In Nevada we have HMO, EPO, and PPO health insurance plan options available to enroll into. When you buy a health insurance plan in the private market, you don’t need to disclose your income or worry about updating your account throughout the year. You set it and forget it. In addition, the prices “OFF Exchange” are often less expensive than “ON Exchange”.

These plans are Qualified Health Plans that contain the 10 Essential Health Benefits that cover pre-existing conditions, no matter what the condition is.

Call for FREE Help

(702) 898-0554

Health Insurance Quotes

Health Insurance Agent

Open Enrollment

Extended Hours

Menu

Or… Just Call Us

(702) 898-0554

Fast and Easy – With Expert Help

One of our licensed agents will guide you step-by-step through your enrollment, answer your questions, and help you find the plan that’s right for you.

Begin Quote

click here

Continue Here

Finish Steps 3-4-5-6

You Have Already Completed

1). Calculate Your Income

This will determine your MAGI (Modified Adjusted Gross Income)

2). Determine Subsidy Eligibility

Using your MAGI, this chart will help determine if you qualify for a subsidy

On This Page

Begin comparing plans and selecting your coverage:

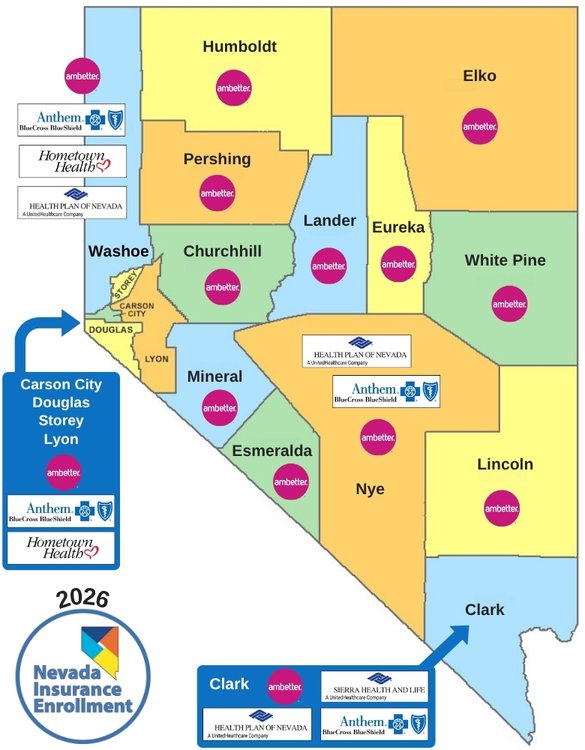

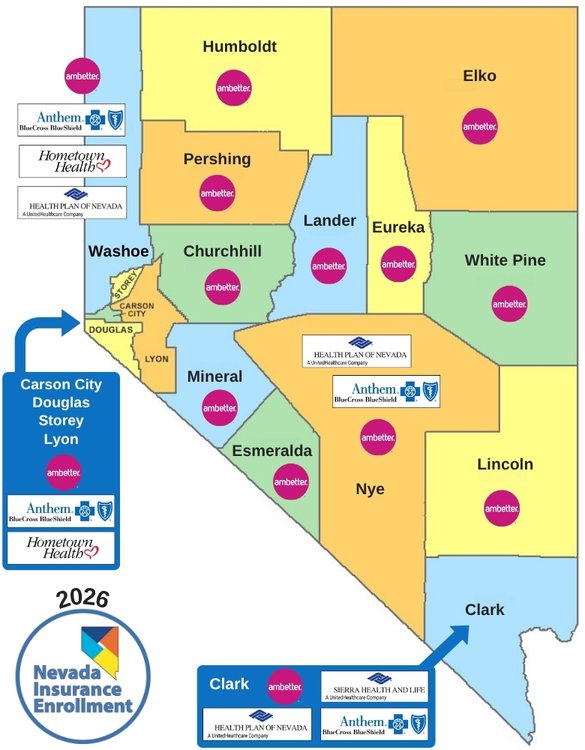

3). Location Options

Use the Nevada counties map to verify insurance availability

4). Select a Metal Tier

Choose between Platinum, Gold, Silver, or Bronze levels to balance your monthly premium with your potential out-of-pocket costs.

5). Compare Plan Networks & Coverage

Verify doctor and hospital networks, prescription coverage, and available urgent or emergency care.

6). Select Insurance Company & Plan

Compare available insurers and plans, reviewing premiums, deductibles, co-pays, coinsurance, and out-of-pocket maximums.

Step #3

Coverage by Location

Active Insurance Companies

Carrier Coverage by County

OFF Exchange

Health Plan of Nevada (HPN)

♦ HMO

♦ ON Exchange and OFF Exchange

>> ON Exchange: Serving ALL Nevada counties

>> OFF Exchange: Clark, Nye, Washoe

Sierra Health and Life

♦ EPO

♦ OFF Exchange only

♦ Clark County only

Ambetter from Silver Summit

♦ HMO

♦ Referrals to see a specialist are not required

♦ ON Exchange and OFF Exchange

♦ Serving ALL Nevada counties

Hometown Health

♦ Offering HMO & EPO in select counties

♦ OFF Exchange only

♦ Serving Carson City, Lyon, Washoe, Douglas, Storey

Anthem Blue Cross and Blue Shield

♦ HMO & EPO

♦ ON Exchange and OFF Exchange

♦ OFF Exchange – Carson City, Lyon, Washoe, Douglas, Storey, Nye, Clark

♦ ON Exchange – Serving ALL Nevada counties

♦ PPO only available for “Catastrophic” plans (under 30 years old)

Select Health

♦ HMO & EPO

♦ ON Exchange only

♦ Serving Nye and Clark County

Renown

♦ HMO

♦ ON Exchange only

♦ Serving Carson City, Washoe, Douglas, and Storey

Imperial Health

♦ HMO

♦ ON Exchange only

♦ Serving Washoe, Nye and Clark County

Molina Healthcare

♦ HMO

♦ ON Exchange only

♦ Serving Washoe, Nye and Clark County

CareSource

♦ HMO

♦ ON Exchange only

♦ Serving ALL Nevada counties

Step #4

Select a Metal Tier

PLATINUM | GOLD | SILVER | BRONZE

Platinum

covers90%of your medical bills until you reach your out-of-pocket maximum

Gold

covers80%of your medical bills until you reach your out-of-pocket maximum

Silver

covers70%of your medical bills until you reach your out-of-pocket maximum

Bronze

covers60%of your medical bills until you reach your out-of-pocket maximum

Step #5

Compare Plan Networks & Coverage

Focus on What Matters Most

When researching health insurance plans or speaking with your agent

Review Key Coverage Details

Then evaluate the options that best fit your needs

Start With the Essentials

-

Doctors & Clinics:

Check that your preferred providers are in-network

-

Prescriptions:

Verify your medications are covered

-

Hospitals & Urgent Care:

Make sure your nearby facilities are included

-

Plan Type:

Decide whether you want an HMO, PPO, or EPO

-

Travel Coverage:

See if you’re covered when traveling or relocating

-

Costs:

Compare deductibles, copays, and coinsurance

-

Out-of-Pocket Limit:

Note the maximum you might pay in a year

Then Consider Your Specific Needs

-

Chronic Conditions:

Coverage for ongoing care like diabetes, heart disease, or high blood pressure

-

Rehabilitation & Recovery:

Coverage for physical therapy, pain management, or post-surgery care

-

Behavioral Health Services:

Coverage for counseling, mental health, or substance abuse programs

-

Virtual Care Options:

Check if the plan includes telehealth or online visits, and whether your providers participate

-

Specialist Access:

Confirm that the types of specialists you may need (e.g., cardiologists, endocrinologists, orthopedists) are available in-network

Step #6

Select a Preferred Carrier

Health Insurance

From the Country's Top Insurance Companies

New for 2026

Battle Born State Plans are Affordable Care Act certified health plans designed to meet premium reduction targets.

(702) 898-0554

or

Begin Quote

click here

Let's Get You Enrolled

#1 - Call Us ⇒ to begin your enrollment / make appointment

OR

#2 - Fill out a short questionnaire ⇒ to request a quote / make appointment

Fast and Easy Enrollment

Enrolling into a health plan is fast and easy when you call one of our licensed and experienced health insurance agents.

Get Advice and Guidance

From a Licensed Local Health Insurance Agent

That Specializes in Nevada Health Plans

Please Be Careful…

So many times, we see honest, hard working people buying what they think are Qualified Health Insurance Plans...

only to find out later that their plan isn’t what they thought it was.

Then, when they find themselves in the hospital, they suffer the consequences of not understanding what they purchased and being severely underinsured.

Once you’ve terminated your qualified health insurance plan, if you don’t have a life event, you won’t be able to sign up for a new plan until the next Open Enrollment.

If the plan you are considering purchasing is a limited benefit medical plan, mini-medical plan, discount plan, indemnity plan, short-term plan, or looks and appears to be “insurance”, but does not cover the 10 “Essential Healthcare Benefits” then you are most likely buying a plan that is NOT considered to be a “Qualified Health Plan”. We STRONGLY recommend you do your research on these types of plans. Do a Google search or look at Yelp reviews of companies that sell these plans.

⇓

People are Selling FAKE Health Insurance

https://www.nevadainsuranceenrollment.com/health/insurance-scams/

Make Sure You're Buying a Qualified Health Plan

QHP’s (Qualified Health Plans):

Will Cover Your Medical Costs With NO Maximum Lifetime and Annual Limits

PLATINUM | GOLD | SILVER | BRONZE

♦ Platinum covers 90% of your medical bills until you reach your out-of-pocket maximum

♦ Gold covers 80% of your medical bills until you reach your out-of-pocket maximum

♦ Silver covers 70% of your medical bills until you reach your out-of-pocket maximum

♦ Bronze covers 60% of your medical bills until you reach your out-of-pocket maximum

Nevada's Premier Private Exchange

Where Nevadans Go To Enroll

Your Trusted Source for Private Health Plan Enrollment in Nevada

Proudly helping Nevadans find quality, affordable coverage for over 15 years

Nevada Health Link

Authorized Agent

Preffered Broker

National Association of Health Underwriters (NAHU)

Nevada Division of Insurance

Agent / Agency Search

Nevada Insurance Enrollment

National Producer License #17264164

Resident Producer Firm License #952196

Health Insurance is Confusing

Let Us Guide You

Don’t Live Nearby?

Kicking back on the patio? At the pool?

Still in your pajamas?

No Problem!

We Can Enroll You Remotely

We help clients all across Nevada. Whether you’re in Las Vegas, Reno, or anywhere in between.

You can enroll right from home! Call us, hop on a video chat, or join a secure screen-share session where you’ll see your agent’s screen as they walk you through every step of your enrollment.

Easy. Personal. Wherever you are.