Nevada Insurance Enrollment

Health Insurance Agency

Purchase Health Insurance

From The Nation’s Top

Health Insurance Companies

We Sell Health Insurance

Local Agents

Nevada Insurance Enrollment is a local Las Vegas family-owned health insurance agency. We help you find the smartest, most comprehensive insurance to fit your specific needs and budget.

We Are an Insurance Broker

Trained and Focused on Nevada Plans

This means we can quote and sell insurance plans from a variety of well-known, respected, and highest rated insurance companies in the country. This lets us shop around for the best plan, at the best price.

We Are Insurance Experts

Licensed and Experienced

For Over 15 years, Nevada Insurance Enrollment Has Specialized in Health Insurance

We care about you, we work for you, we’re experienced and we’re local. Talk with a friendly, knowledgeable, licensed health insurance agent.

Free Health Insurance Quotes

We Find You The Best Plan For The Best Price

No Agents Fees… Ever!

We Don’t Just Sell Health Insurance, We Actually Care.

Serving Las Vegas, Henderson, North Las Vegas and the entire state of Nevada.

Health Insurance

Individual & Family

under 65

Medicare

Health Insurance

65 & over

Auto Insurance

Farmers Insurance:

Shelly Rogers Agency

Medicaid

Health Insurance

low income

Group

Health Insurance

for Businesses

Dental & Vision

Health Insurance

Individuals & Family

Final Expense

Life Insurance

Funeral/Burial/Cremation

Menu

Health Insurance Quotes

1). By Phone

(702) 898-0554

2). Online Quote

Short Questionnaire

3). In Person

4260 W. Craig Road #150-A

N. Las Vegas, NV 89032

Begin Quote

click here

Nevada’s Premier Private Exchange

Where Nevadans Go To Enroll

Why Work With Us?

We Are Professional Health Insurance Agents…

It’s What We Do

For over 15 years, Nevada Insurance Enrollment has specialized in health insurance.

- We are NOT seasonal staff

- We are NOT a faraway 1-800 number

- We ARE local, licensed agents

- We DO study Nevada plans

- We WILL guide you step-by-step

- We WILL help with billing, claims, membership

Health Insurance Open Enrollment Has Begun

You Can Only Buy Health Insurance During This Time

November 1st, 2025 ⇒ January 15th, 2026

unless you have a ‘Life Event’

After 1/15/2026

You Will Need a Life Event To Get Health Insurance

Open Enrollment

Extended Hours

Begin Quote

click here

Las Vegas Health Insurance Agent

Serving Las Vegas, Henderson, North Las Vegas, and the entire state of Nevada

Licensed Health Insurance Agents

Help You and Guide You

♦ They STUDYNevada plans and benefits

♦ They UNDERSTANDhow the insurance industry works

♦ They handle any MEMBERSHIPcommunication

♦ They help you understand how your CHOICESaffect your tax return

♦ They HELPyou, and are available year after year, all year long

♦ They KNOWwhat’s happening in the insurance industry

♦ They ASSISTwith billing questions or claims problems

♦ They GUIDEyou to avoid very costly pitfalls

♦ They are FREEto use. Why would you NOT use an agent or broker?

Health Insurance

From the Country’s Top Insurance Companies

Why choose Nevada Insurance Enrollment?

Having a health insurance agent doesn’t cost you anything (the service we offer is FREE) because the insurance company pays us to assist you. Plus, our service doesn’t stop once you purchase a plan, you’ll get help and expert advice with your initial sign up and through every step of owning an insurance policy.

So why not have an educated, experienced and caring professional at your service (that has years of experience and dozens of insurance companies to choose from) shop around for you…at no additional charge!

What Does a Health Insurance Agent Do?

Health insurance agents are professionals who specialize in connecting people with the insurance policies that are right for them. They help the customers understand their insurance coverage and how their choices will affect their tax return, preventing costly pitfalls and gaps in coverage. Customers who work with health insurance agents receive the insurance policies that are tailored to their needs at the best price available.

The best part of all? The services of an insurance agent are free to customers. That’s right; insurance agents are paid by the insurance company, meaning that customers have access to this specialized assistance while someone else pays the bill.

Does Your Current Insurance Agent Re-evaluate Your Insurance Plan Each and Every Year With You?

If not…why not?

The most important reason to have a health insurance agent is to have someone willing to stay up to date with current plans, rates, programs etc.

Having an agent doesn’t cost you anything; your rates will be the same with or without an agent. The insurance company pays the agent to assist you. So it just makes sense to have a professional evaluate your circumstances at least once a year to make sure you are in the very best place for your needs and budget.

Professional Insurance Services That Are Free to You

Think that cutting out the middleman always saves money? Think again! Using the specialized services of a professional health insurance agent doesn’t cost you a dime. Sure, you could do all of the footwork yourself, but spending hours wading through industry jargon and cross-checking policies won’t save you any money. In fact, you may be at risk of under-insuring your assets, potentially jeopardizing your financial security. Working with a health insurance agent ensures that you get the best insurance coverage for your needs and lifestyle at the best rate available.

Comparison Shopping with an Insurance Broker

When it comes to shopping around for health insurance, it can be hard to ensure that you’re making accurate comparisons. Products, policy limits, deductibles, premiums, and available discounts all vary from one company to another, making it difficult to accurately evaluate prices and coverage options. An insurance agent has the knowledge and expertise to accurately cross-compare insurance companies.

Insurance Agents Provide Personalized Service

Unless you have a background in the insurance industry, understanding the coverage options that you have available can be difficult. Your health insurance agent sits down with you to discuss a full range of factors, including your budget, lifestyle, and the value of your assets, and then tailors an insurance policy that is just right for you. On top of that, if you ever need to file a claim, we are here to help, are local, and will always have your back. We can help guide you through the process from start to finish.

We are a “Broker” which means we do not work for just one health insurance company but actually shop numerous insurance companies. We work hard to fit you into the absolute smartest, most affordable health insurance plan that conforms to your income and your needs. We work for YOU, not the insurance company. We will personally take you step-by-step through all the plans (from all the available insurance companies) and find the one best suited for you.

Our friendly, knowledgeable, licensed, and local health insurance agents make it easy to get a quote and enroll. We are available all year long – year after year. We have been helping people find the right insurance coverage and get the most for their money for over 15 years. If you want an agent that actually cares about you, you’ve come to the right place.

Expert Advice at NO Cost!

Having an agent doesn’t cost you anything (the service we offer is FREE) because the insurance company pays us to assist you.

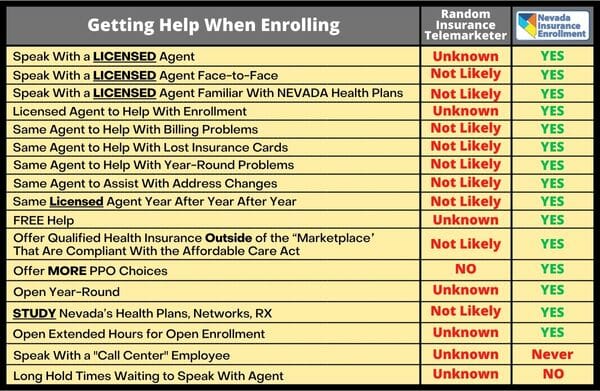

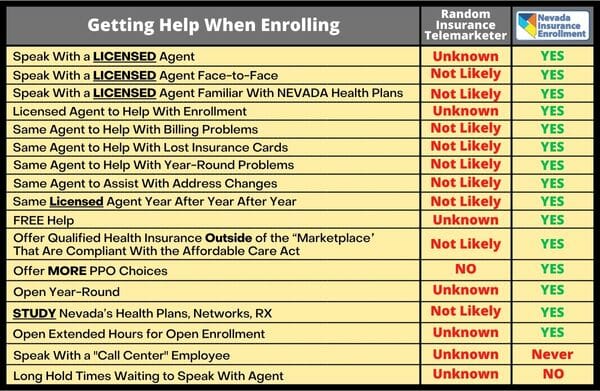

Let’s Compare Services

Nevada Insurance Enrollment

vs.

Random Insurance Telemarketer

Nevada’s Premier Private Exchange

Where Nevadans Go To Enroll

Your Trusted Source for Private Health Plan Enrollment in Nevada

Proudly helping Nevadans find quality, affordable coverage for over 15 years

Nevada Health Link

Authorized Agent

Preffered Broker

National Association of Health Underwriters (NAHU)