Be Cautious With Your Insurance Subsidy

You will have to pay the amount you were OVER SUBSIDIZED back to the IRS.

If you received a Government subsidy last year for your Health Insurance, you could end up owing the IRS money.

Call For FREE Help (702) 898-0554

Subsidies, they are great! But you HAVE to get your income correct! When you claim you will make a certain amount of money in a year and you receive a subsidy from the government to help pay your health insurance premiums, you must notify them of any changes. Be honest in stating your income! There are very serious consequences to playing games with your income.

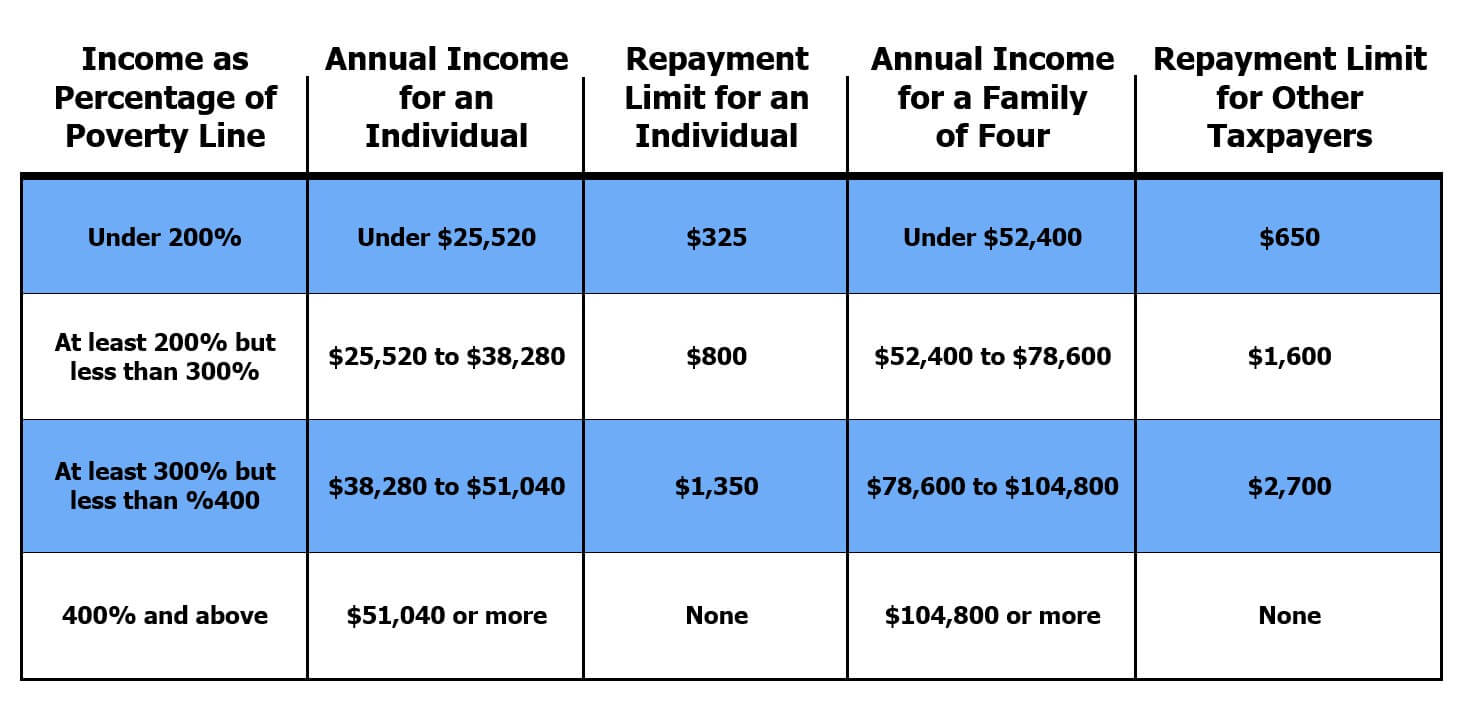

What’s the most I would have to repay the IRS?

Repayment Limits for Advanced Premium Tax Credits: 2021 Tax Year

If you forget to make an adjustment to your income or even your family size, and the government keeps subsidizing your health insurance, you will have that money taken out of your tax refund when you file your taxes, or you will have to pay it back to the IRS.

We suggest that any time you have a change to your income or your family, that you call us. Let us know of the changes and we will take care of making the adjustments to your account to keep you straight and out of trouble.

If you’ve had a “Life Event” like having a baby, get divorced, married, adopted, began to receive health coverage through a job or spouses/parents job, and have a health insurance plan through the Governments website that has a subsidy, you’ve GOT to let them know! This subsidy to help pay for health insurance is an on-going process. Anytime you fill out a health insurance application through their website and get a subsidy, you cannot expect to fill out the application once a year and figure you are done until the next year. Any “Life Event” will affect your “subsidy” (including changes to your income), up or down you’ll need to update your account. These changes affect your advanced premium tax credit amount.

The “Advanced Premium Tax Credit” (APTC) is the subsidy (the monthly amount the government is paying to help you pay your premiums) that helps you afford your health insurance plan. The IRS at the end of the year will adjust what you’ve received, and what you should have received, and that will be taken from your tax refund, or worse, you’ll have to pay the IRS back. If your income went down, or you had more people in your family to support on the same income, then you may be entitled to get a larger tax refund.

If you have an income that goes up and down monthly, you’ll want to make those changes monthly, or try to average the income out monthly and divide by 12 months. You can also estimate your yearly income and at the end of the year, the IRS will calculate if you were over-subsidized (received too much subsidy and you owe money), or under-subsidized (you get a refund).

Call Us For Assistance

(702) 898-0554

Get a Fast & Free Online Quote

Discussing Subsidies With Nevada Insurance Enrollment

Navigating through the many options of insurance can be confusing and difficult, but speaking with a local, licensed insurance agent, will help you to obtain the right coverage you need. You’ll want to have the peace of mind knowing that you are properly insured when life complications arise. We work hard to find the most competitive quotes for your needs. Contact us today to begin the process of finding the best insurance plan for your family.

Related Articles:

♦ Be Careful Stating Your Income For Health Insurance Subsidy

♦ What is a Government Health Insurance Subsidy?

♦ Health Insurance Subsidy aka Advanced Premium Tax Credit

♦ Health Insurance in Las Vegas, Nevada WITH a Subsidy

Read More: Health Insurance in Las Vegas, Nevada

Call us for assistance

(702) 898-0554

Serving Las Vegas, Henderson, North Las Vegas and the entire state of Nevada

Three Ways to Enroll

1). Apply by Phone

(702) 898-0554

2). Apply in Person

(by appointment ONLY)

Please call to make an appointment

3). Online Quote

Why Go Anywhere Else?

When you can have an experienced and caring professional guide you.

Insurance Quotes | Plans | Coverage

Nevada Insurance Quotes

Serving Las Vegas, Henderson, North Las Vegas and the entire State of Nevada

Auto | Homeowners | Health | Life | Medicare | Funeral / Cremation | Group Health | Short Term | Dental & Vision | Travel Insurance

Authorized Agent for: Nevada Health Link, Anthem Blue Cross & Blue Shield, Sierra Health & Life, Health Plan of Nevada, Aetna, Prominence, Hometown Health, Ambetter/Silver Summit

Farmers Insurance – Shelly Rogers Agency in Las Vegas, Nevada