NEW

Extended Hours For Open Enrollment

You do not want to understate your income or you could end up owing money to the IRS.

For example, if your premiums are $1,000/month and you get an Advanced Premium Tax Credit of $800/month only paying $200/month for your health insurance. When you do your taxes and file your tax return each year, the Government will check your income. If you were only supposed to receive an Advanced Tax Credit of $700/month instead of $800/month, you’ll owe the IRS an extra $100/month x 12 months which would equal $1,200 that you would owe the IRS.

The Advanced Premium Tax Credit is an “estimation” of your pre-tax credit, so if you’ve received too much “credit,” you’ll end up paying it all back, or a portion of it back. Your percentage of Federal Poverty Level determines this.

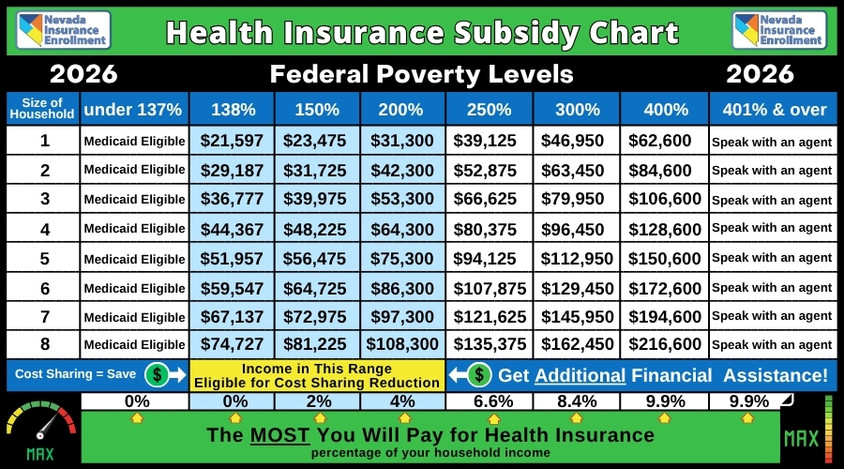

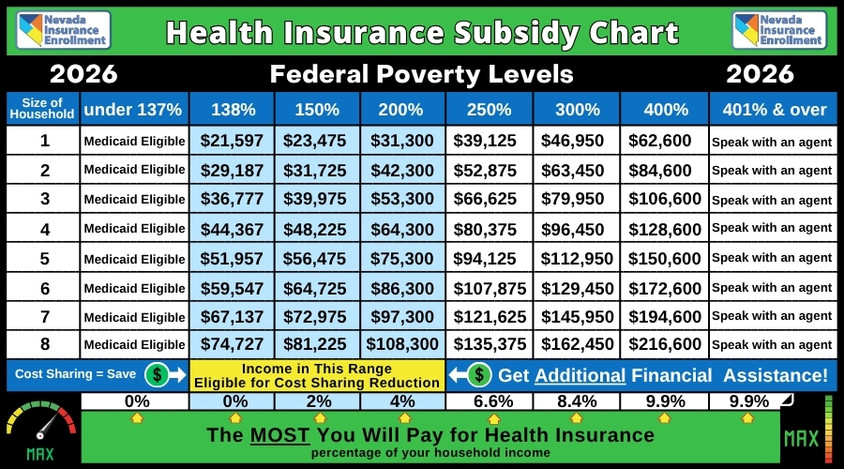

The chart below lists the income numbers the IRS will use for subsidy eligibility.

* The annual subsidy amounts change in January of each year

NOTE: You can buy a plan outside of the “Marketplace” that doesn’t have a subsidy

1). If your income is between 138% to 400%, you may be eligible for a health insurance subsidy.

2). If your income is between 138% to 200%, you may be eligible for a subsiby and additional benefits.

3). If your income is less than 138%, you may qualify for Medicaid. If it turns out you do not qualify for Medicaid after applying, come back to this page and begin enrollment.

1). WITH a Government Subsidy:

Where the Government helps you pay your premiums (You must qualify, based on your income and family size). If you want to apply for a Government subsidy you’ll be enrolling into a health insurance plan on the exchange, which is where you enroll.

2). With NO Government Subsidy:

You don’t qualify for a Government subsidy because you make too much money, OR you just don’t want a subsidy. No questions on income are required. If you want to buy your own plan without a Government subsidy, or know you won’t qualify for Government help because you make too much money each year, you can shop and enroll into health insurance “Off Exchange”, which means you are buying a health insurance plan in the private Market with no subsidy.

3). Medicaid:

Medicaid is a joint State/Federal health insurance program that is administered by the State. It provides health coverage for low-income individuals, especially pregnant women, children and the disabled. The Division of Welfare and Supportive Services (DWSS) determines eligibility for the Medicaid program.

⇒

Check

Your

Eligibility

(702) 898-0554

or

click here

OR

Enrolling into a health plan is fast and easy when you call one of our licensed and experienced health insurance agents.

Then, when they find themselves in the hospital, they suffer the consequences of not understanding what they purchased and being severely underinsured.

Once you’ve terminated your qualified health insurance plan, if you don’t have a life event, you won’t be able to sign up for a new plan until the next Open Enrollment.

If the plan you are considering purchasing is a limited benefit medical plan, mini-medical plan, discount plan, indemnity plan, short-term plan, or looks and appears to be “insurance”, but does not cover the 10 “Essential Healthcare Benefits” then you are most likely buying a plan that is NOT considered to be a “Qualified Health Plan”. We STRONGLY recommend you do your research on these types of plans. Do a Google search or look at Yelp reviews of companies that sell these plans.

⇓

We help clients all across Nevada. Whether you’re in Las Vegas, Reno, or anywhere in between.

You can enroll right from home! Call us, hop on a video chat, or join a secure screen-share session where you’ll see your agent’s screen as they walk you through every step of your enrollment.